justineanweiler.com – Decentralized Finance, commonly known as DeFi, is a transformative movement in the financial world that leverages blockchain technology to create open, permissionless, and transparent financial systems. By eliminating intermediaries, DeFi empowers users with greater control over their assets and enables access to a wide range of financial services.

What is DeFi?

DeFi refers to a suite of financial applications built on blockchain networks, primarily Ethereum. Unlike traditional financial systems, which rely on centralized entities such as banks and payment processors, DeFi operates on decentralized protocols and smart contracts. These smart contracts are self-executing agreements with predefined rules encoded on the blockchain, ensuring trustless and transparent operations.

Key Features of DeFi

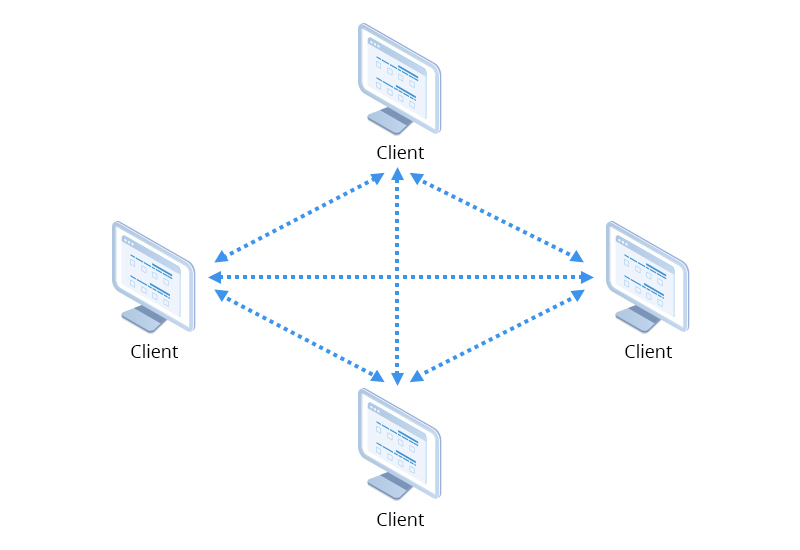

- Decentralization: Transactions and operations occur on a distributed network, removing the need for centralized authorities.

- Accessibility: DeFi platforms are open to anyone with an internet connection and a digital wallet, enabling global financial inclusion.

- Transparency: Blockchain technology ensures that all transactions and smart contract codes are publicly auditable.

- Interoperability: DeFi applications often integrate seamlessly, allowing users to move assets across platforms effortlessly.

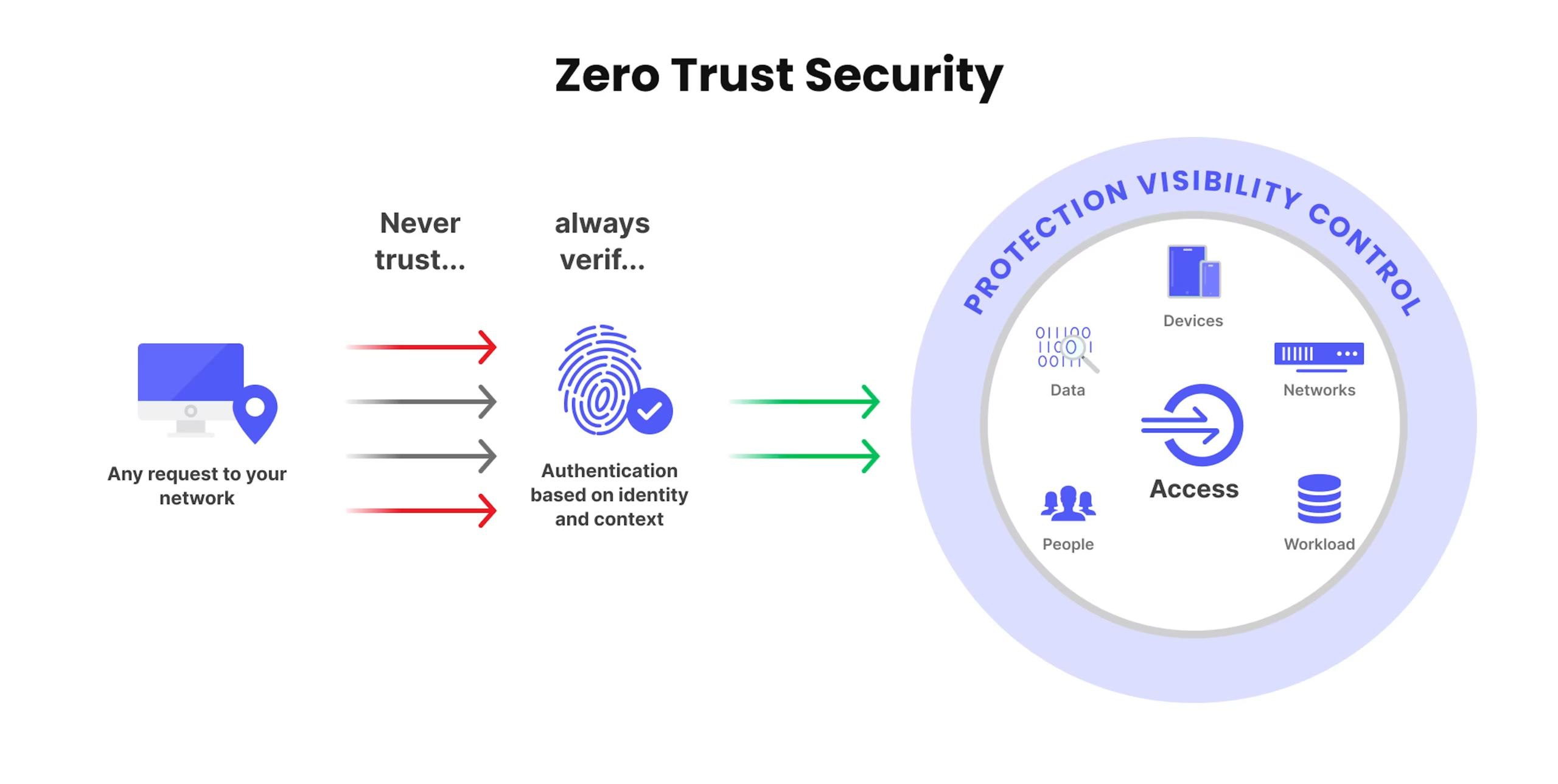

- Security: While the blockchain’s cryptographic nature offers strong security, the security of individual DeFi platforms depends on the robustness of their code.

Core Components of DeFi

- Decentralized Exchanges (DEXs): Platforms like Uniswap and SushiSwap allow users to trade cryptocurrencies directly without intermediaries, using automated market-making protocols.

- Lending and Borrowing Platforms: Services such as Aave and Compound enable users to lend their assets to earn interest or borrow against collateral, often without traditional credit checks.

- Stablecoins: Cryptocurrencies like DAI and USDC are pegged to stable assets such as the US dollar, providing stability and utility in the DeFi ecosystem.

- Yield Farming and Staking: These mechanisms allow users to earn rewards by providing liquidity to platforms or locking their assets in protocols.

- Insurance: Platforms like Nexus Mutual offer decentralized insurance solutions to protect against risks in the DeFi space, such as smart contract failures.

Advantages of DeFi

- Financial Inclusion: DeFi opens up financial services to the unbanked and underbanked populations worldwide.

- Efficiency: Automated processes and reduced reliance on intermediaries lower costs and improve transaction speeds.

- Innovation: DeFi fosters rapid experimentation and the creation of novel financial products.

Challenges and Risks

- Regulatory Uncertainty: The lack of clear regulations poses challenges for adoption and compliance.

- Smart Contract Vulnerabilities: Bugs or exploits in code can lead to significant losses.

- Market Volatility: The value of assets in DeFi can fluctuate drastically, impacting users.

- Scalability Issues: High transaction volumes on blockchains like Ethereum often result in congestion and high fees.

The Future of DeFi

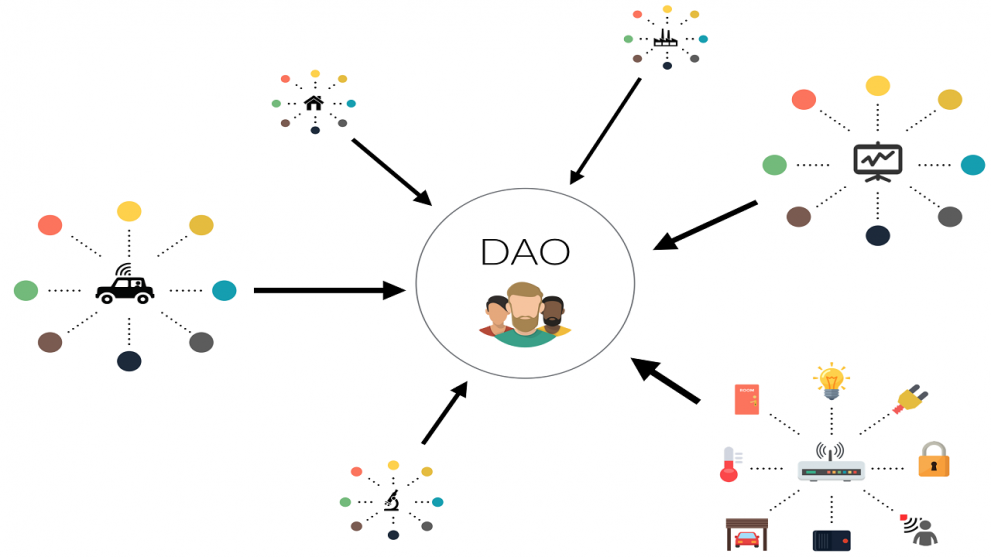

DeFi is at the forefront of reshaping the financial landscape. With advancements in blockchain scalability, cross-chain interoperability, and regulatory clarity, the sector is poised for mainstream adoption. The rise of decentralized autonomous organizations (DAOs) and layer-2 scaling solutions further strengthens its potential.

As the ecosystem evolves, DeFi promises to democratize finance, making it more inclusive, efficient, and resilient. While challenges remain, the continued innovation and collaboration within the space highlight the transformative power of decentralized finance.

Conclusion

DeFi is more than just a trend; it represents a fundamental shift in how we think about money, transactions, and financial systems. By putting control back into the hands of individuals, DeFi is paving the way for a more equitable and transparent global economy.

Leave a Reply