justineanweiler.com – In the modern business landscape, efficient accounting and financial management are critical for success. With the rise of cloud computing and digital tools, businesses of all sizes now have access to powerful software solutions that can streamline their financial operations, improve accuracy, and help make better financial decisions. In this article, we explore some of the best online tools and software for accounting and financial management that every business should consider.

1. QuickBooks Online: The Go-To for Small to Medium-Sized Businesses

QuickBooks Online is arguably one of the most popular accounting software solutions for small to medium-sized businesses. Known for its user-friendly interface, QuickBooks offers a variety of features that cater to both novice and experienced users.

Key Features:

- Invoicing and Payments: Create customizable invoices and accept payments online.

- Expense Tracking: Automatically track expenses by connecting your bank accounts and credit cards.

- Tax Preparation: Simplifies tax filing by generating financial reports and organizing your tax data.

- Multi-User Access: Allows accountants and team members to access the software simultaneously.

- Integrations: Syncs with over 650 business apps, including PayPal, Shopify, and Square.

QuickBooks Online is perfect for businesses looking for a reliable and scalable tool that grows with their needs.

2. Xero: Cloud-Based Accounting for Growing Businesses

Xero is another cloud-based accounting software that caters to small and medium-sized businesses. Known for its intuitive design and powerful accounting features, Xero is a great option for companies looking for real-time collaboration and seamless accounting management.

Key Features:

- Real-Time Collaboration: Multiple users can work on the system at once, with updates syncing automatically.

- Bank Reconciliation: Automatically imports bank transactions and matches them to invoices, saving time on manual data entry.

- Inventory Management: Track stock levels, manage suppliers, and create purchase orders—all from one place.

- Payroll Management: Offers an integrated payroll solution for managing employee salaries, taxes, and other payroll-related processes.

- Customizable Reports: Generate detailed financial reports such as balance sheets, profit and loss statements, and cash flow statements.

Xero’s cloud-based model makes it ideal for businesses that want to access their financial data from anywhere.

3. Wave Accounting: A Free Solution for Small Businesses

Wave Accounting offers a robust suite of accounting features completely free of charge, making it an excellent choice for small businesses or freelancers just starting out. While the free version includes the core features needed for effective financial management, Wave also offers premium services like payroll and payments.

Key Features:

- Double-Entry Accounting: Wave follows double-entry accounting, ensuring accuracy in financial statements.

- Invoice Creation and Payment: Create customized invoices and accept online payments.

- Expense Tracking: Categorize your expenses and connect your bank account for easy reconciliation.

- Financial Reports: Automatically generate reports like income statements, balance sheets, and cash flow statements.

- Receipts Scanning: Scan and upload receipts to help track business expenses.

Wave Accounting is a great starting point for small business owners who want to manage their finances without a significant upfront investment.

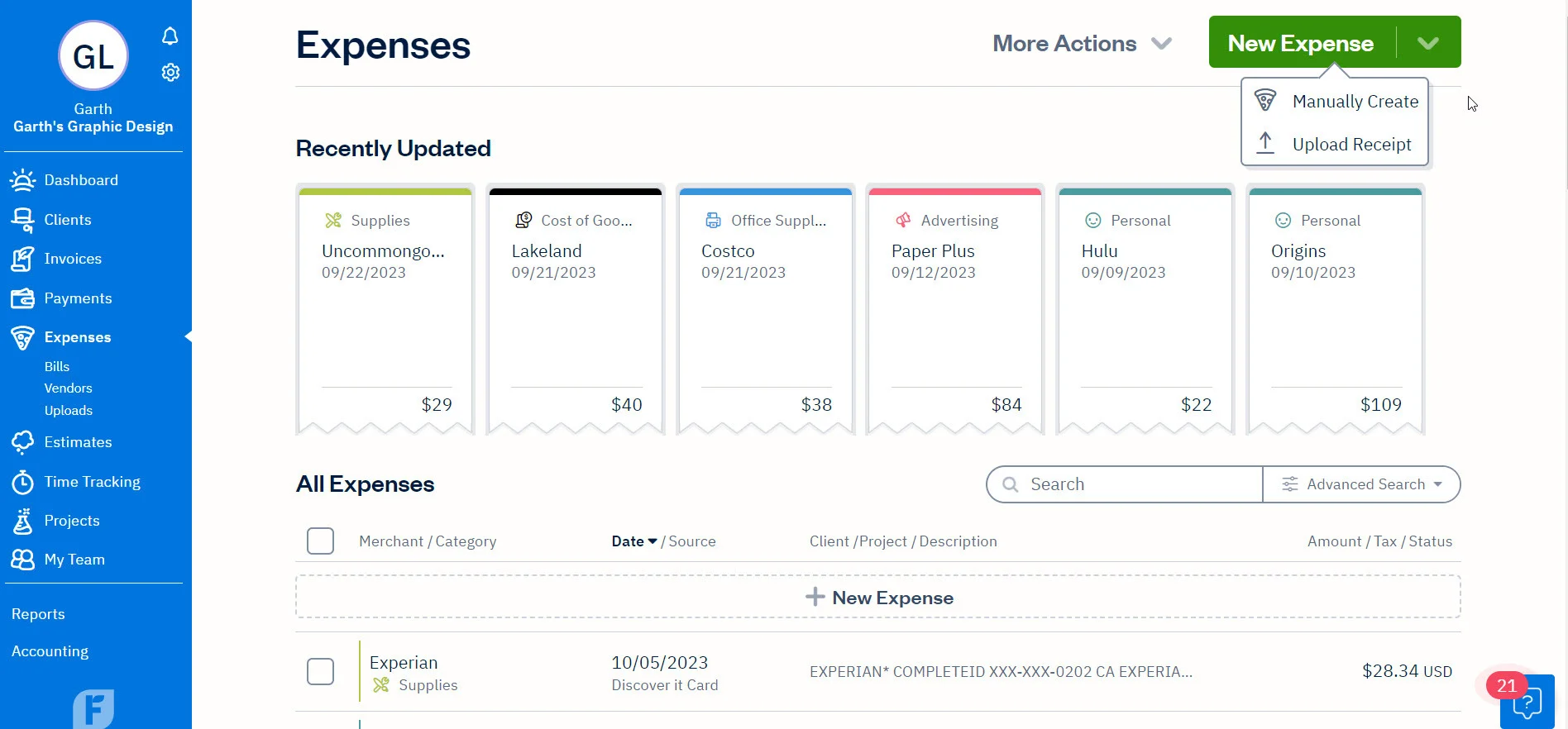

4. FreshBooks: Simple Accounting for Service-Based Businesses

FreshBooks is known for its simplicity and ease of use, making it an ideal choice for freelancers, consultants, and service-based businesses. Although it’s not as feature-rich as some of the other accounting software options, it excels at what matters most: invoicing and expense management.

Key Features:

- Invoice Management: Create professional-looking invoices, set automatic reminders, and accept online payments.

- Time Tracking: Perfect for service-based businesses that bill clients by the hour.

- Expense Tracking: Connect your credit card or bank account to automatically categorize and track your expenses.

- Client Portal: Clients can log in to view their invoices, make payments, and track their spending.

- Project Management: Allows you to manage multiple projects, set budgets, and track the time spent on each project.

FreshBooks is a great choice for service-oriented businesses looking for simple accounting and invoicing tools.

5. Zoho Books: Comprehensive Financial Management for Small Businesses

Zoho Books is an integrated online accounting software that offers a full suite of accounting and finance management features. Known for its affordability and customization options, Zoho Books is perfect for small businesses that want to automate and simplify their financial tasks.

Key Features:

- Invoice and Payment Management: Create and send invoices with customized templates, track payments, and send payment reminders.

- Expense and Time Tracking: Track project expenses, time spent on tasks, and set hourly rates for clients.

- Inventory Management: Manage your inventory and create purchase orders to keep your stock levels in check.

- Bank Reconciliation: Connect your bank accounts for automated transaction syncing and reconciliation.

- Client and Vendor Management: Maintain a centralized database of all your clients and vendors for easy communication and transaction tracking.

Zoho Books provides an all-in-one solution for businesses looking to streamline their accounting, invoicing, and financial reporting.

6. Kashoo: Simple and Affordable Accounting Software

Kashoo is designed for entrepreneurs and small businesses that need a straightforward, affordable accounting solution. It offers simplicity in its features while still providing the essential tools for managing finances and taxes.

Key Features:

- Invoicing and Payments: Easily create invoices, track payments, and send payment reminders.

- Expense Tracking: Automatically categorize and track business expenses.

- Real-Time Financial Dashboard: Access a real-time snapshot of your financial performance.

- Tax Reports: Prepare for tax time by generating detailed tax reports, including GST/HST reports for Canada-based businesses.

- Multi-Currency Support: Ideal for businesses with international clients or transactions.

Kashoo is a simple, cost-effective choice for small business owners who need an easy-to-use platform without a lot of bells and whistles.

7. Microsoft Dynamics 365 Finance and Operations: Enterprise-Level Financial Management

Microsoft Dynamics 365 is a powerful ERP (Enterprise Resource Planning) and financial management software solution designed for larger businesses and enterprises. It integrates seamlessly with other Microsoft products and offers a wide range of advanced financial and operational tools.

Key Features:

- Financial Planning and Analysis: Conduct in-depth financial forecasting, budgeting, and analysis to improve decision-making.

- Account Payable and Receivable: Manage accounts payable, receivable, and optimize cash flow.

- Compliance and Tax Management: Ensure compliance with industry standards and tax regulations.

- Supply Chain Integration: Manage procurement, inventory, and vendor relations all within the same system.

- Advanced Reporting: Generate sophisticated reports on financial data, profitability, and performance metrics.

Microsoft Dynamics 365 is a top-tier solution for large businesses and enterprises with complex financial operations.

Conclusion: Choosing the Right Financial Tool for Your Business

Selecting the right accounting and financial management tool depends on the size, complexity, and nature of your business. For small businesses and startups, affordable options like Wave or FreshBooks can provide essential features at a low cost. On the other hand, medium-sized businesses may benefit from the more robust offerings of QuickBooks, Xero, or Zoho Books. Large enterprises with more complex financial needs might require enterprise-level solutions like Microsoft Dynamics 365.

In today’s digital age, investing in the right online accounting software can save your business time, improve accuracy, and streamline your financial processes, helping you focus on growth and success.